The Benefits of 1099 vs. W2 for Employers & Workers

What’s The Difference Between a 1099 and W2?

A W2 and a 1099 are both tax forms used in the United States, but they serve different purposes and are issued under different circumstances. A W2 form is used by employers to report the wages, salaries, and other compensation paid to their employees during the tax year. This includes information on the amount of federal, state, and local taxes withheld from the employee's paychecks, as well as contributions to Social Security and Medicare. Employees use the information on their W2 to file their income tax returns and calculate their tax liability.

A 1099 form, on the other hand, is used to report payments made to independent contractors, freelancers, and other non-employees who are not considered traditional employees. This includes payments for services rendered, such as consulting fees, rent, royalties, or other types of income. Unlike W2s, 1099 forms do not include information on tax withholding or Social Security and Medicare contributions, as these are the responsibility of the recipient.

In summary, W2s are used to report wages and salaries paid to employees, while 1099s are used to report payments made to independent contractors and other non-employees. The key difference between the two forms is the nature of the relationship between the payer and the payee, with W2s used for traditional employer-employee relationships, and 1099s used for non-employee arrangements.

Businesses Benefits of 1099 Workers

A business might use a 1099 employee (also known as an independent contractor) for a number of reasons:

Flexibility

Hiring a 1099 employee allows the business to have more flexibility in terms of scheduling and workload, as they are not bound by the same legal and regulatory requirements that apply to traditional W-2 employees.

Cost Savings

Because independent contractors are not entitled to the same benefits and protections as traditional employees, such as health insurance, paid time off, or unemployment insurance, they can be less expensive for businesses to hire.

Expertise

Businesses may need specific expertise for a project or task that they do not have in-house. Hiring a 1099 employee can provide access to specialized skills and knowledge without the need to hire a full-time employee.

Lower Liability

Independent contractors are responsible for their own taxes, insurance, and other business expenses, which can reduce the liability and administrative burden on the business.

Supplemental/ On-Demand Shifts

If a business has a short-term project that requires additional resources, hiring a 1099 employee can be a cost-effective way to fill that need without committing to a long-term employee.

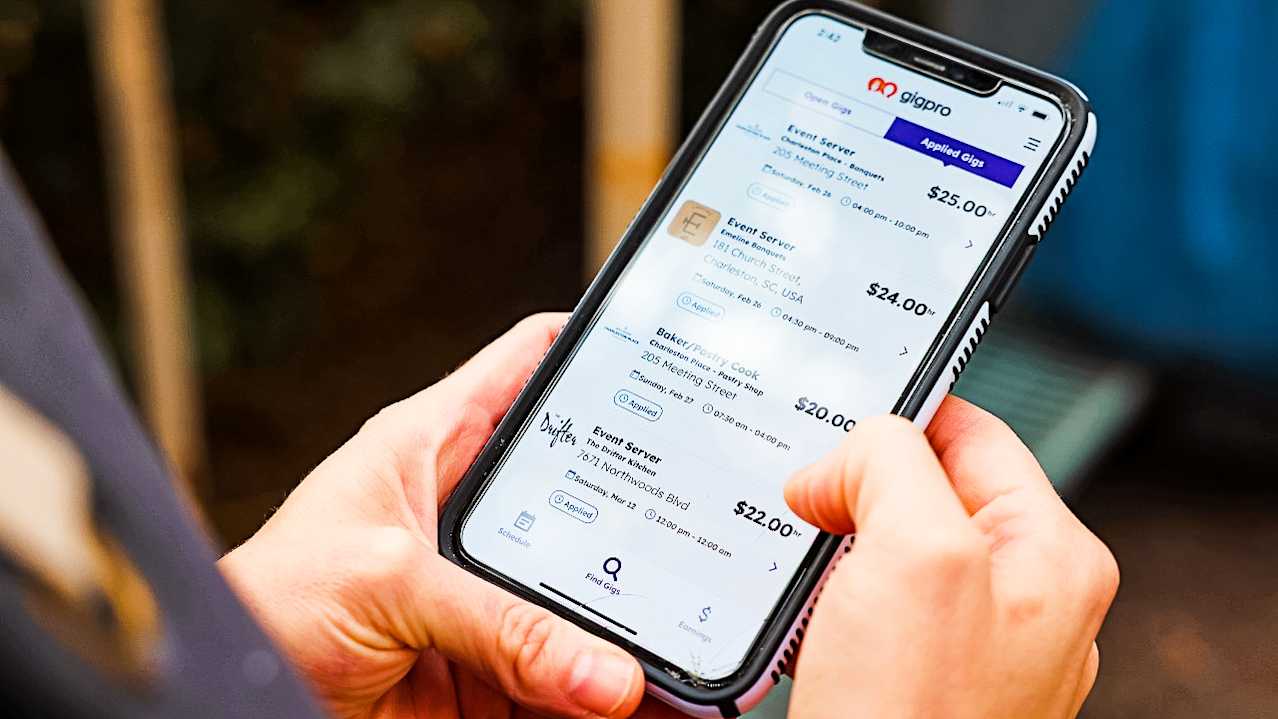

For businesses, the benefit of using Gigpro to fill shifts is that we provide a seamless matching app to pair your shift needs with qualified workers in your area. Not only does Gigpro provide workers on demand, but we also take care of all of the paperwork involved, saving you and your team time, energy, and money. There is no time-consuming review of resumes, paperwork to process, or hidden fees.

Pro Benefits of Being an Independent Contractor

Here are some advantages of being paid as a 1099 independent contractor for those that have never tried Gig work before:

Greater Flexibility and Control

Independent contractors have more control over their work and schedule than traditional employees

Higher Earning Potential

Independent contractors may be able to charge higher rates for their services than traditional employees, particularly if they have specialized skills or experience.

More Tax Deductions

Independent contractors can deduct certain business-related expenses from their income, reducing their taxable income and potentially lowering their tax bill.

Potential For Multiple Clients

Independent contractors are not tied to a single employer, and can work for multiple clients at the same time, potentially increasing their income and reducing their risk of job loss.

Opportunity For Entrepreneurship

Being an independent contractor can be a pathway to starting your own business and developing your own client base.

Pros will receive a 1099 for earnings on the Gigpro marketplace if they cross the independent contractor tax threshold for the given year. Occupational Accident Insurance (OAI) is $0.38 per hour and is deducted from earnings. This is a mandatory policy so we can ensure everyone is covered. Payments are available after two business days. We also offer instant payout if the payout method is a debit card. There are no fees for Pros on the platform.